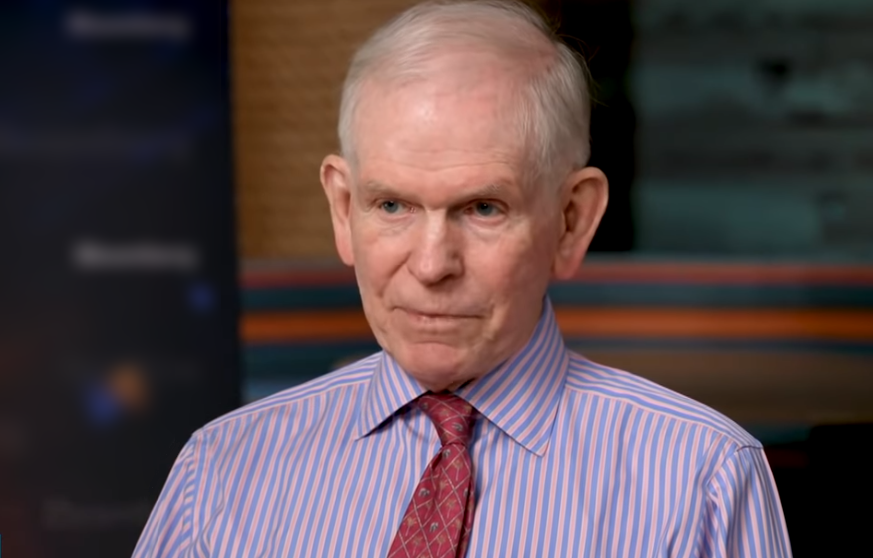

Inside Jeremy Grantham's World: Net Worth, Predictions & More

Is the financial world on the precipice of another devastating collapse? Jeremy Grantham, the British investor renowned for forecasting market bubbles and financial crises, believes the answer is a resounding yes, and he's not afraid to sound the alarm. His insights, often delivered with a stark and chilling accuracy, have earned him a reputation as one of the most astute observers of the global financial landscape. His warnings are not for the faint of heart, as they paint a picture of potential market turmoil that should make any investor pause and reflect.

Grantham's pronouncements are not mere speculation; they are the result of years of meticulous analysis and a deep understanding of market cycles. He's known for his ability to identify periods of irrational exuberance and predict when the inevitable correction will occur. His expertise has made him a figure of both respect and fear in the financial community, as his predictions, though often dire, have a remarkable track record. His specialty, terrifying an audience, is a testament to his unwavering commitment to delivering the truth, even when that truth is uncomfortable.

Here's a glimpse into the life and career of this influential figure:

- Hugh Fearnleywhittingstall Net Worth River Cottage Lifestyle

- Jimmie Vaughan Net Worth How Much Is The Blues Legend Worth

| Full Name | Jeremy Grantham |

| Nationality | British |

| Born | 1938 (Estimated) |

| Education | University of Sheffield (Economics); Harvard Business School (MBA) |

| Occupation | Investor, Co-founder of GMO |

| Known For | Predicting market bubbles and financial crises |

| Net Worth (Estimated) | $1 Billion |

| Company | GMO (Grantham, Mayo, & van Otterloo) |

| Current CEO of GMO | Scott Hayward |

| Key Positions | Co-founder and Chief Investment Strategist at GMO |

| Philanthropy | Significant involvement in environmental causes |

| Investment Philosophy | Value investing, contrarian approach, focus on identifying market imbalances |

| Notable Predictions | Dot-com bubble burst, 2008 financial crisis, current warnings about the "super bubble" |

| Website for Reference | GMO Official Website |

Grantham's investment journey has been marked by his firm conviction in value investing and a contrarian approach to the market. His focus on identifying market imbalances has allowed him to recognize overvalued assets and anticipate market corrections. He doesn't shy away from making bold predictions, even when they run counter to the prevailing sentiment. This willingness to challenge conventional wisdom has been crucial to his success, but also the source of controversy.

He's still waiting for the bubble to pop. His recent warnings about a "super bubble" in the U.S. stock market highlight his continued vigilance and his belief that the market is once again entering dangerous territory. Grantham has accurately predicted previous financial crises and market tops, making his current assessment all the more significant.

While the exact timing of market corrections is impossible to predict, Grantham's analysis offers valuable insights for investors. He urges investors to be cautious and prepared for potential downturns. His track record speaks volumes, and his insights offer a valuable perspective for anyone navigating the complexities of the financial markets. He's noted that opportunities to net such attractive gains may prove more limited.

- Jim Umplebys 2023 Pay How Much Did The Caterpillar Ceo Make

- Sam Calagiones Net Worth How Much Is The Dogfish Head Founder Worth

The city of Boston, Massachusetts, where GMO is based, and Doncaster, South Yorkshire, are linked by Grantham's personal history. Both places hold a special significance for the investor. As of the latest corporate shareholdings filed, Jeremy Grantham publicly holds a substantial number of stocks, with a net worth estimated to be over US$ 31.1 billion. These figures are constantly evolving based on market conditions and Grantham's personal investments. The value can be affected by market conditions, the performance of GMOs funds, personal investments, and his philanthropic activities, all factors that could affect Granthams net worth.

GMO, the investment firm co-founded by Grantham, has a significant presence in the financial world. At one point, it managed over US$118 billion in assets. Though that figure has fluctuated over time, it underscores the influence of Grantham and his firm. In December 2020, the firm's assets under management were reported to be around $65 billion. The current CEO of GMO Investments is Scott Hayward, who took over from Michael Moe in December 2013.

Grantham's predictions are not always welcomed, but they are always respected. When he heard a colleague recount sharing a bus ride from New Hampshire to Boston with a young woman who wanted to sell her house to invest in stocks, alarm bells went off. This anecdote illustrates the kind of speculative behavior that often precedes a market correction.

Grantham's net worth, currently estimated to be around $1 billion, reflects his successful career as an investor. The $55,000 investment by a foundation, which yielded $12 million, is a testament to the potential for significant returns in the market. It also highlights the risks associated with speculation, and the importance of careful analysis.

Grantham's insights on the market are often sought after. His views are valued by investors around the world. In his recent statements, he suggested the stock market has a 70% chance of crashing, which is a bold statement. The current portfolio and holdings of Jeremy Grantham (GMO Asset Management) include a total portfolio value of $30.9 billion invested in 2204 stocks, reflecting the diversity of his investments.

The market is influenced by various factors. The enthusiasm for artificial intelligence and the sentiment surrounding political events are driving the stock market to record highs this year, which reminds Grantham of past experiences. The market's current state is a reflection of those conditions.

The history of investing is full of lessons. One of the most important lessons is the need to be prepared for both gains and losses. The recent rise of the market is another episode that highlights the inherent risk in any investment. When the bubble bursts, the economic consequences can be devastating. Grantham's legacy is based on his ability to analyze market data, identify trends, and deliver tough messages.

Grantham's expertise extends beyond the market. His philanthropic efforts demonstrate his commitment to addressing environmental challenges. He is involved in funding initiatives that combat climate change and promote sustainability.

The $55,000 of the foundation's commitment the fund invested in snap made us 220 times our money, or $12 million, Grantham said. Opportunities to net such attractive gains may prove more limited. As investor enthusiasm for artificial intelligence, and lately for a trump presidency, has been driving the stock market to record highs this year, Jeremy Grantham has been having flashbacks. Legendary investor Jeremy Grantham says the stock market has a 70% chance of crashingand it could be an epic burst like the 1929 crisis. Longtime doomsayer has an investment tip published: 11, 2023 at 12:48 p.m.

- Adedeji Adeleke Net Worth Wealth Latest Updates Insights

- Nigel Havers Net Worth 2024 Career Wife More

Legendary Investor Pledges 1 Billion to Fight Climate Change

Jeremy Grantham's investment bubble gains extend to his venture capital

Jeremy Grantham and Goldman Sachs Have One Thing in Common They Both